|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

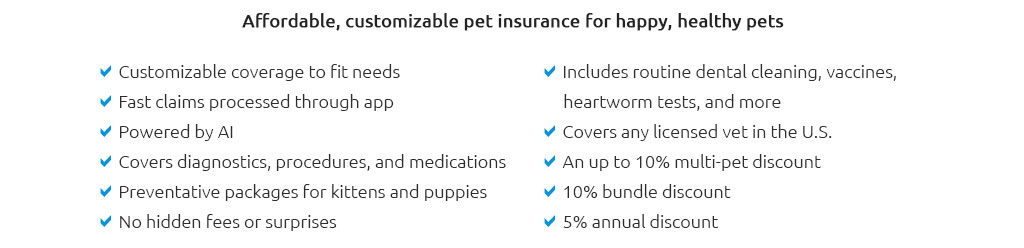

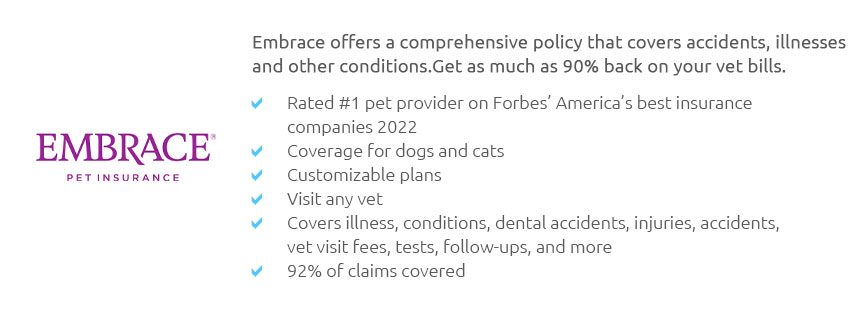

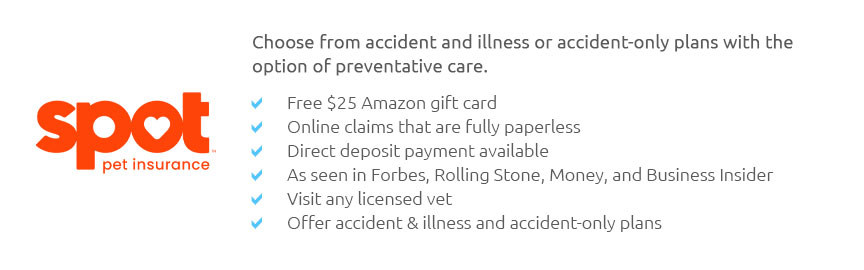

Understanding Pet Insurance in Oregon: Important ConsiderationsWhen it comes to ensuring the well-being of our beloved furry companions, pet insurance has emerged as an increasingly popular option, particularly in states like Oregon, where the love for pets is abundant and the care provided is exceptional. While the decision to purchase pet insurance might seem straightforward at first glance, there are numerous factors to consider that can significantly influence the choice of the best policy for your cherished pet. Let's delve into the key aspects that every pet owner in Oregon should be mindful of when contemplating pet insurance. First and foremost, it is crucial to understand what pet insurance actually covers. While many plans offer comprehensive coverage, including accidents, illnesses, and even some routine care, others may only cover specific incidents. It is imperative to thoroughly read and compare the policy details, as not all insurance plans are created equal. For instance, some policies might cover hereditary and congenital conditions, which are particularly relevant for certain breeds. Researching and selecting a plan that aligns with your pet's specific needs can save you from unexpected financial burdens. Another vital consideration is the choice between an annual and a lifetime coverage plan. Annual plans might appear more economical upfront, but lifetime plans ensure continued coverage, especially as your pet ages and becomes more prone to health issues. This is especially pertinent in Oregon, where outdoor activities are a common lifestyle choice for many pet owners, potentially increasing the risk of accidents or illnesses. Moreover, understanding the reimbursement structure is essential. Some policies reimburse a percentage of the vet bill, while others may pay a set amount per condition. Knowing how much you can expect to be reimbursed can help in budgeting for future medical expenses. Additionally, the choice of veterinarian can impact your pet insurance experience. Oregon boasts a plethora of highly qualified veterinarians, but not all insurance providers cover every clinic. Ensuring that your preferred veterinarian is within the network of your chosen insurance provider can prevent inconvenient and costly situations. Furthermore, it is beneficial to inquire about any waiting periods before the coverage kicks in, as some conditions might not be covered if they arise during this period. Cost is undeniably a significant factor in deciding whether to purchase pet insurance. While it might be tempting to opt for the cheapest policy available, it is important to weigh the cost against the potential benefits. A slightly higher premium could provide broader coverage, thus offering peace of mind in situations where extensive veterinary care is required. In Oregon, where the cost of living and veterinary services can be relatively high, investing in a comprehensive plan might prove to be financially prudent in the long run.

In conclusion, while pet insurance in Oregon offers an invaluable safety net for pet owners, the decision to purchase a policy should be made after careful consideration of various factors. By understanding the nuances of policy coverage, costs, and provider networks, pet owners can make informed decisions that ensure their pets receive the best possible care. With a thoughtful approach, pet insurance can provide not just financial protection but also peace of mind, knowing that your furry family member is covered in times of need. https://www.petinsurance.com/whats-covered/oregon/

Get comprehensive pet insurance coverage in Oregon. Protect your furry friend's health and save on vet bills with Nationwide. Explore our plans today! https://www.healthypawspetinsurance.com/locations/or/oregon-pet-insurance

We offer one pet insurance plan that covers vet visits for new accidents and illnesses at competitive premiums. https://www.lemonade.com/pet/explained/oregon-pet-insurance-guide/

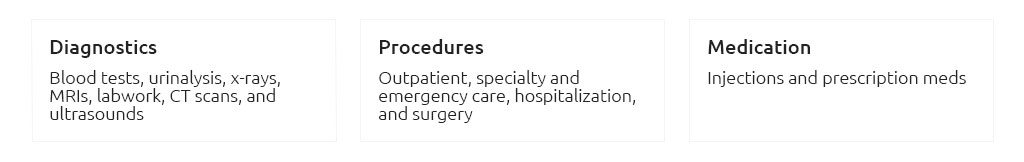

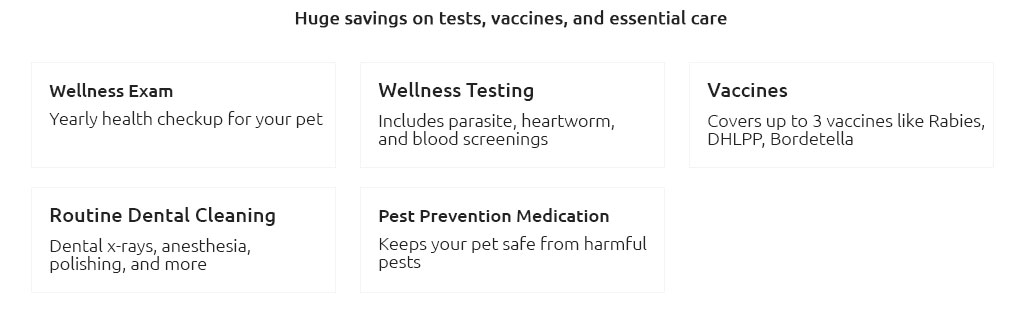

eligible accidents and illnesses. Here are some common types of care that Lemonade pet insurance ...

|